- The following ecosystem participants jointly provide all functionalities a centralized exchange has to offer.

…

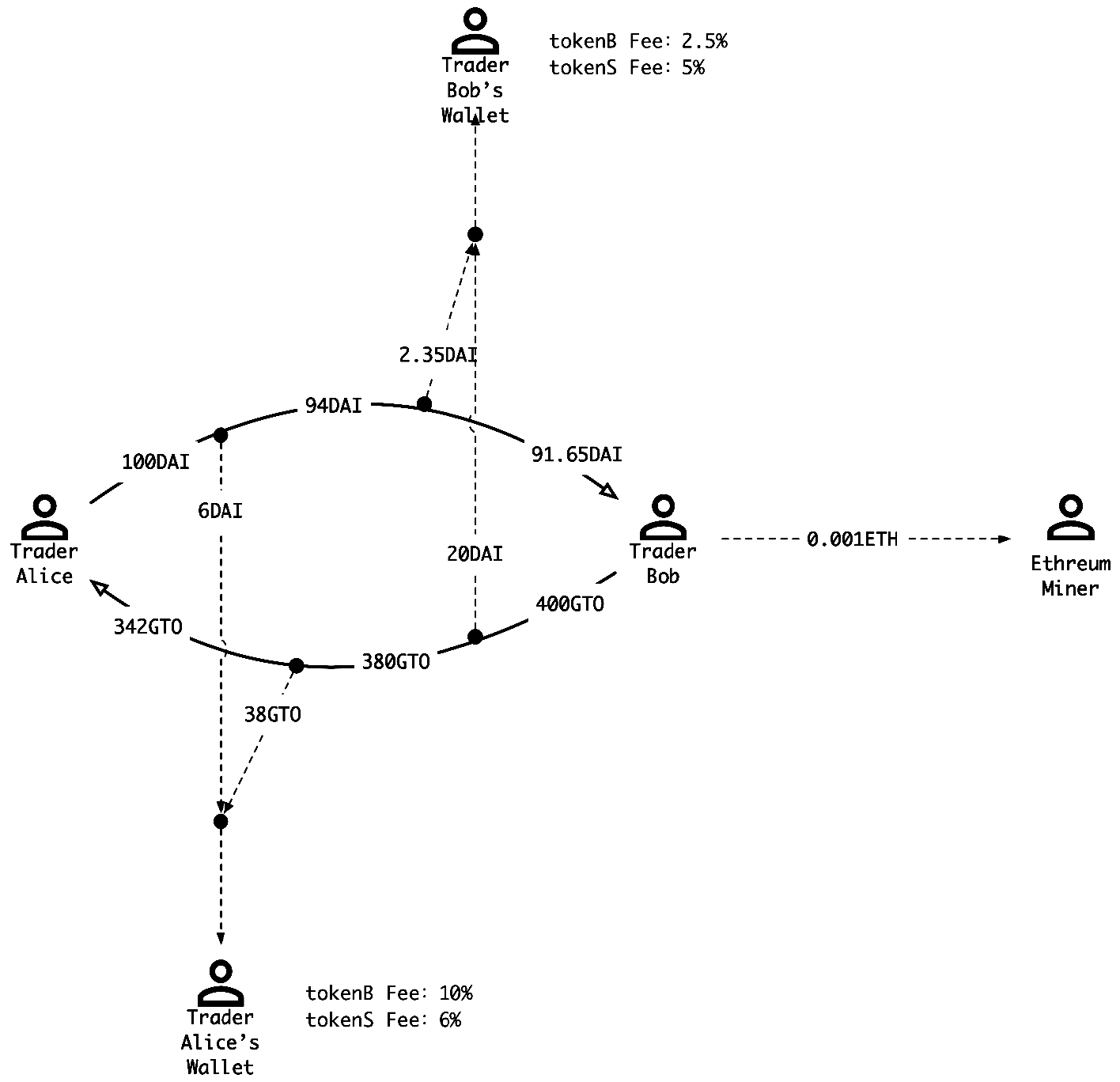

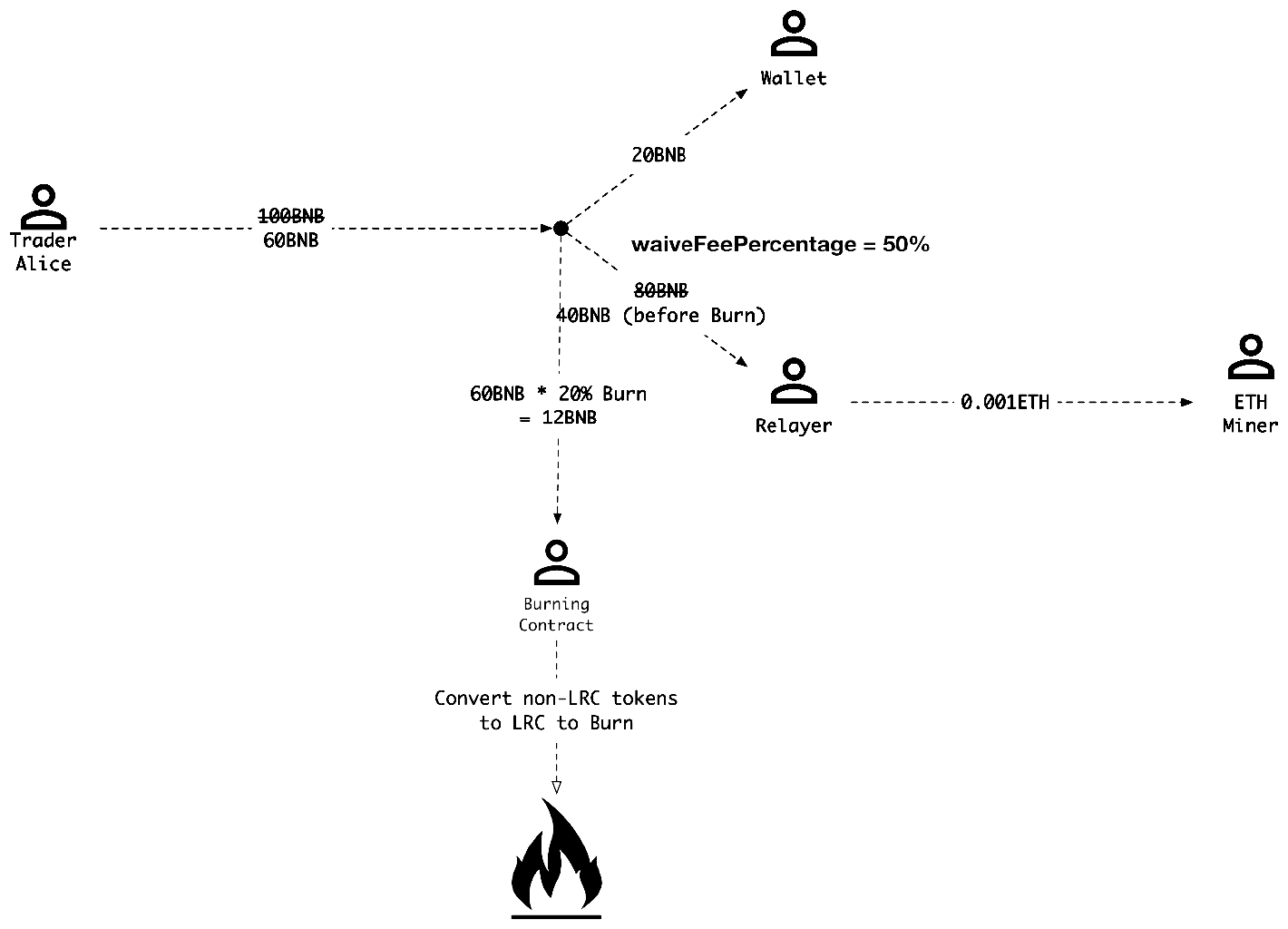

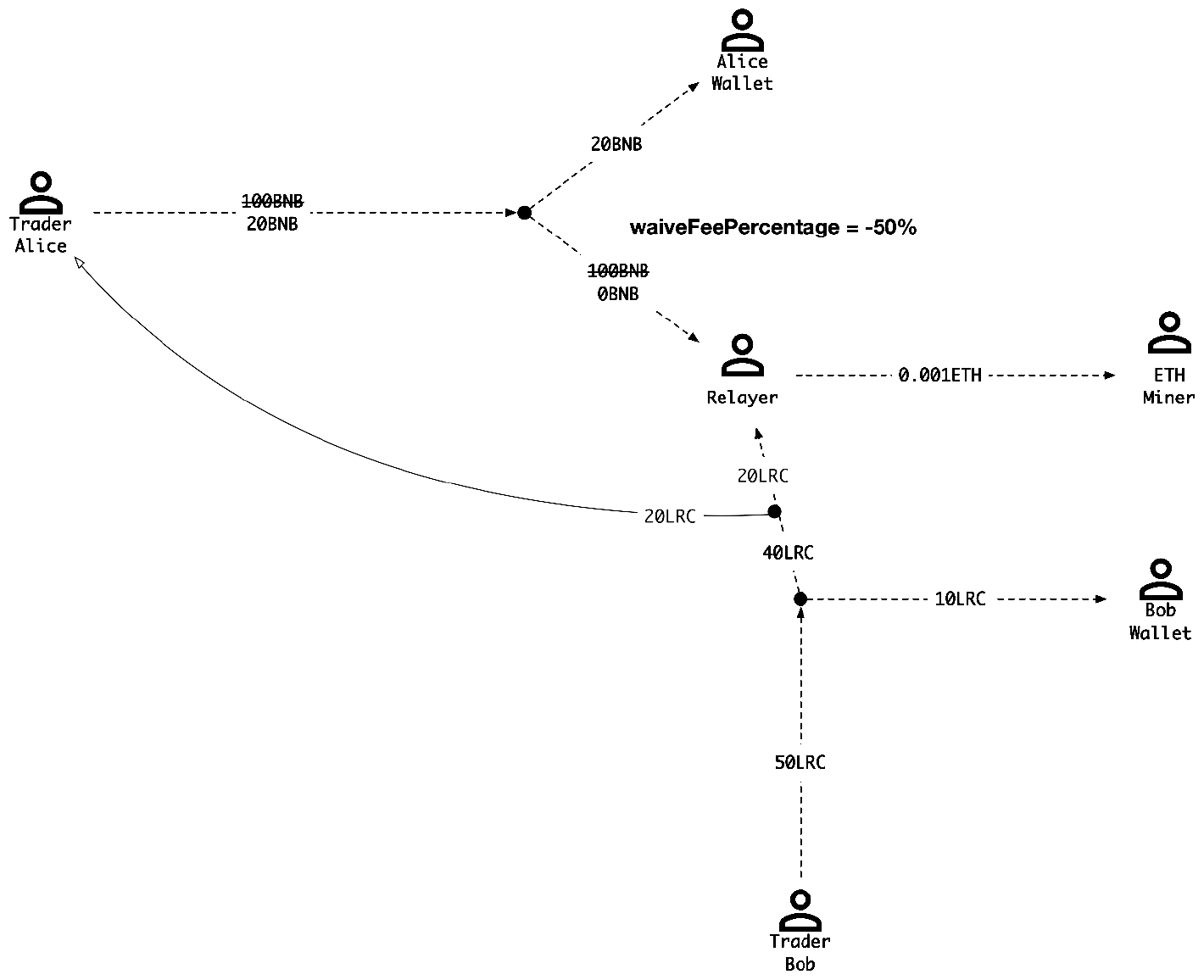

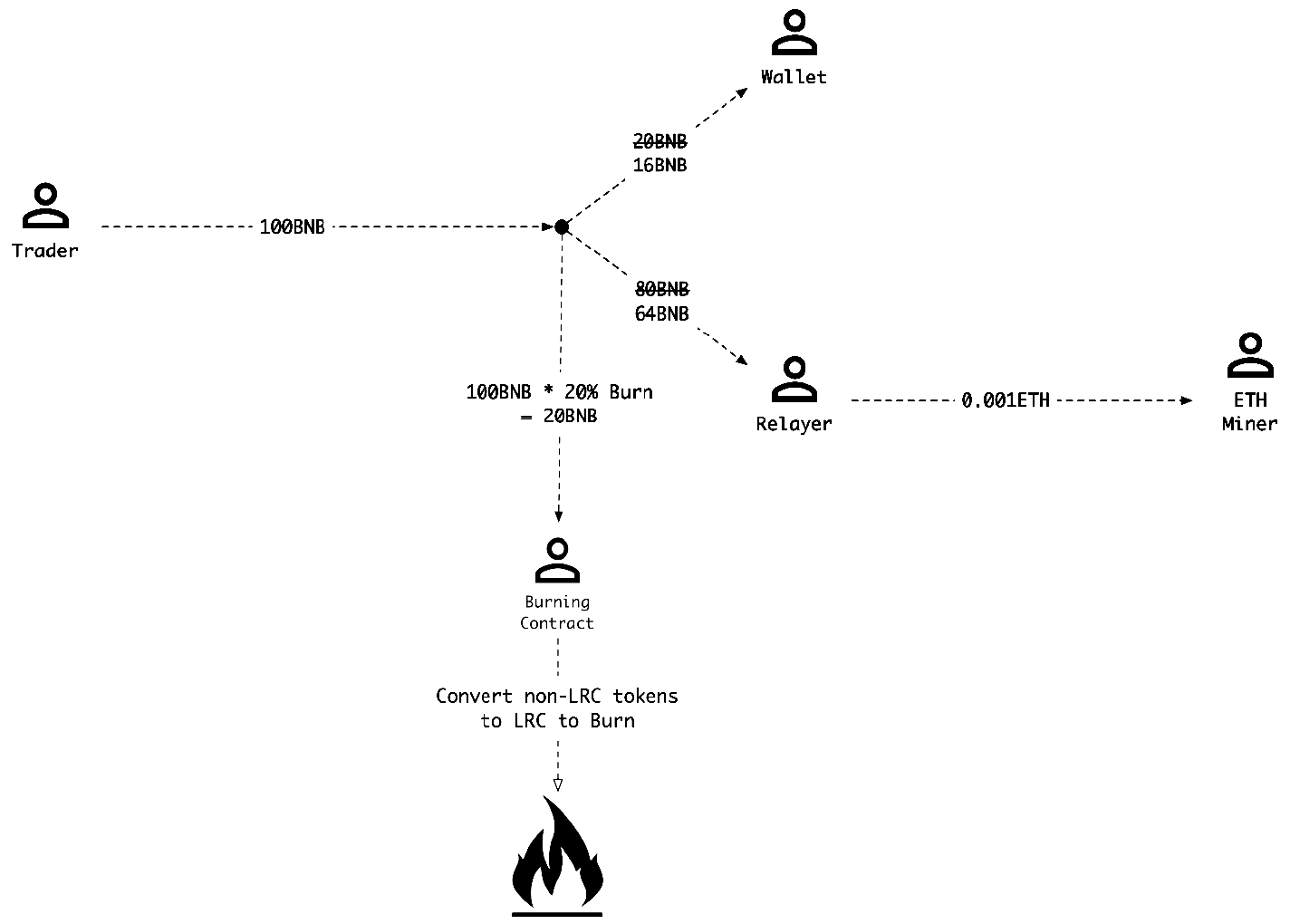

- • Wallets: A common wallet service or interface that gives users access to their tokens and a way to send orders to the Loopring network. Wallets will be incentivized to produce orders by sharing fees with ring-miners (see section 8). With the belief that the future of trading will take place within the safety of individual user’s wallets, connecting these liquidity pools through our protocol is paramount.

- • Consortium Liquidity Sharing Blockchain/RelayMesh: A relay-mesh network for order & liquidity sharing. When nodes run Loopring relay software, they are able to join an existing network and share liquidity with other relays over a consortium blockchain. The consortium blockchain we are building as a first implementation has near real time order sharing (1-2 second blocks), and trims old history to allow for faster download by new nodes. Notably, relays need not join this consortium; they can act alone and not share liquidity with others, or, they can start and manage their own liquidity sharing network.

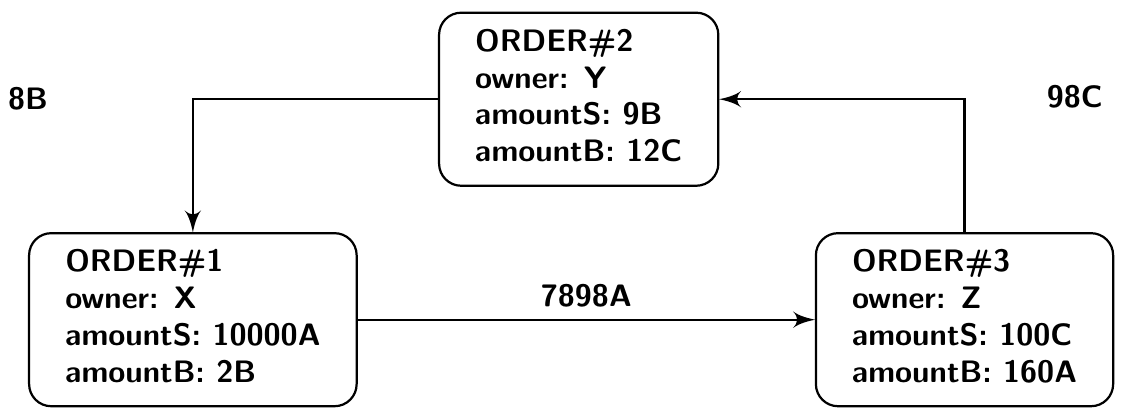

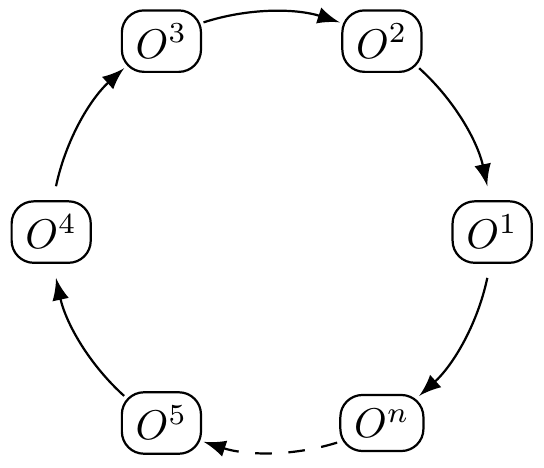

- • Relays/Ring-Miners: Relays are nodes that receive orders from wallets or the relay-mesh, maintain public order books and trade history, and optionally broadcast orders to other relays (via any arbitrary off-chain medium) and/or relay-mesh nodes. Ringmining is a feature – not a requirement – of relays. It is computationally heavy and is done completely off-chain. We call relays with the ring-mining feature turned on “Ring-Miners”, who produce order-rings by stitching together disparate orders. Relays are free in (1) how they choose to communicate with one another, (2) how they build their order books, and (3) how they mine order-rings (mining algorithms).

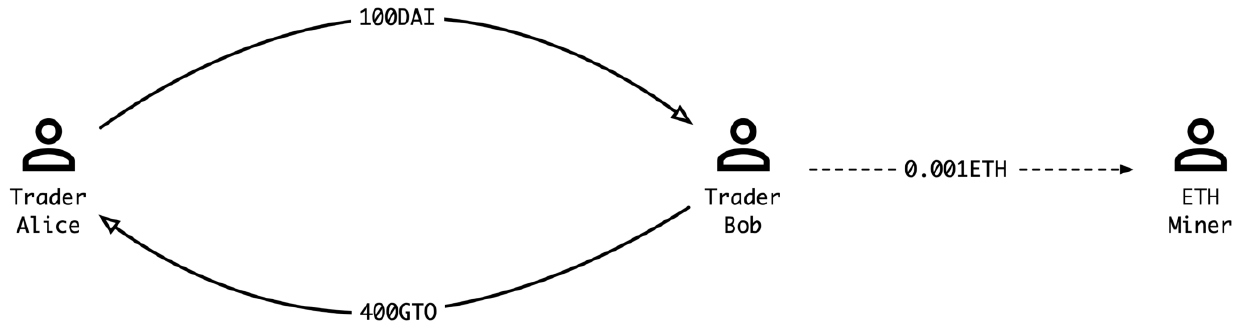

- • Loopring Protocol Smart Contracts (LPSC): A set of public and free smart contracts that checks order-rings received from ring-miners, trustlessly settles and transfers tokens on behalf of users, incentivizes ring-miners and wallets with fees, and emits events. Relays/order browsers listen to these events to keep their order books and trade history up to date. See appendix ?? for details.

- • Asset Tokenization Services (ATS): A bridge between assets that cannot be directly traded on Loopring. They are centralized services run by trustworthy companies or organizations. Users deposit assets (real, fiat or tokens from other chains) and get tokens issued, which can be redeemed for the deposit in the future. Loopring is not a cross-chain exchange protocol (until a suitable solution exists), but ATS enable trading of ERC20 tokens [18] with physical assets as well as assets on other blockchains.